Structuring Ownership Of Multiple Companies: Part 2

Structuring Ownership Of Multiple Companies

Part 2-Same Owner Or Subsidiary

This is Part 2 of a multi-part series on how to structure the ownership of multiple companies. The premise is that you already own a company called ABC, LLC and you are thinking of starting another one, or you are going to buy another company. How should you structure the ownership of these two entities? There are a lot of options, and each one has its own advantages and disadvantages. In Part 1, we wrote about the new company being a division within the existing ABC, LLC. In this post we discuss what happens when you want to spin the division out on its own as a separate LLC. Part 3 will disucss the structure when you want a partner in only one of the companies.

One of the key reasons to have your new company, XYZ, LLC be a separate entity is that you don’t want the assets of ABC, LLC to be at risk because of the liabilities of XYZ, LLC. Limited liability protection of LLCs means the owner’s assets may not be attacked to pay the debts of the LLC. If XYZ, LLC has a judgment against it, the assets of the owner’s other company, ABC, LLC, will not be attacked to pay the judgment. You have two choices for how the two companies can be owned:

- Separate Companies, Same Owner

- Separate Companies, Parent-Subsidiary

Separate Companies, Same Owner

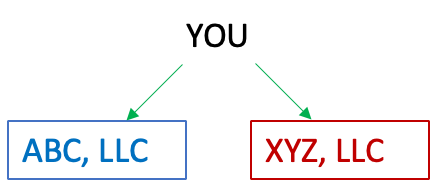

Of course you have can own multiple companies on your own so this would be the structure:

You must register the new XYZ, LLC to do business in your State, and XYZ, LLC needs its own EIN from the IRS. You need to keep the money of the two companies completely separate so each must have its own separate bank account. This separation of finances is necessary so no one can argue that you are treating the two companies as if they were one company. If you comingle funds, a creditor may argue that ABC, LLC and XYZ, LLC are in fact one and the same so their joint assets may be attacked to pay off debts of either one.

This concept of keeping the companies separate financially extends beyond merely the bank accounts, it applies to personnel and physical assets as well. In Part 1 I mention one of the most attractive aspects of having XYZ be a division within ABC, LLC is that you can easily share resources between ABC, LLC and its division XYZ. You may not do that so freely with the companies being separated like this. If you want some employees to split their time between ABC, LLC and XYZ, LLC, then those employees need to know at all times which company they are working for. And they must be paid for their time out of separate bank accounts. Assets may be placed on loan from ABC, LLC to XYZ, LLC, but that loan must be documented by an agreement.

Bottom line is that whenever the companies interact, you need to treat ABC, LLC and XYZ, LLC as if they were owned by completely separate people–what is referred to as “arms length transactions.” Another example of an arms-length transaction involves the use of brand identities that are protected by registered trademarks. Keep in mind that a trademark on a logo or name (the name of a product or the name of a company) is property. Property has one owner, but it can be licensed to other entities. So if you want XYZ, LLC to market a product that has a trademark owned by ABC, LLC, you need to have a license agreement between the two companies. If you sell one company but not the other company, then the existence of this license agreement may be a material advantage (or a material disadvantage, depending on what the buyer wants to do with the trademark).

The two companies will also file separate tax returns. This filing requirement is a minor additional expense over the cost of a single tax return when XYZ was a division of ABC, LLC. But the separation of financial activities becomes painfully noticeable if you want to use the profits of ABC, LLC to help fund the operations of XYZ, LLC. You will have to take the profits out of ABC, LLC to you personally as the owner, and then you can invest those funds into XYZ, LLC. Alternatively, you can have ABC, LLC lend the money to XYZ, LLC. Either way, the losses of XYZ, LLC cannot be used to offset the profits of ABC, LLC. Any offset must be done on the tax return at the owner level.

In addition, when XYZ, LLC does become profitable, XYZ, LLC’s value improves the income and balance sheet of the owner, not ABC, LLC. If it is your intention to keep the two companies completely separate, to grow them separately, and to prepare each of them to be sold separately, then this Separate Companies, Same Owner structure is best for you.

But if the products and services of the two companies are complimentary, it’s entirely possible that a potential buyer of ABC, LLC might want to buy the operations of XYZ, LLC as well. This might be the case, for example, if XYZ, LLC was formed to provide the same services ABC, LLC does, only in a distinct geographical market. In that case, it would be better if the two companies were more tightly linked to each other.

The way to address this last issue is with a different structure: Separate Companies, Parent-Subsidiary

Separate Companies, Parent-Subsidiary

In this structure, the new business XYZ, LLC is placed in a legal separate LLC that is owned exclusively by your original company, ABC, LLC. XYZ, LLC is a subsidiary of ABC, LLC.

All of the requirements of keeping separate financial records still apply to this wholly-owned subsidiary structure. ABC, LLC can more easily invest directly in XYZ, LLC, and the profits and balance sheet of XYZ, LLC go to improve the profits and balance sheet of ABC, LLC directly. This structure clearly benefits the value of ABC, LLC and is clearly likely to make it more valuable in a sale–unless you don’t want the subsidiary to be included in the sale of ABC, LLC.

In addition, the IRS allows a specialy treatment of the profits and loses of the two companies in this particular scenario. If ABC, LLC is treated as subchapter S-Corp entity for taxation, and XYZ, LLC is created as a corporation or LLC taxed as a corporation, then you can file a Q-Sub election to have the combined operations of the two companies reported on a single tax return with the combined income/loss passing through to the owner (you) of ABC, LLC. So even though you need to keep separate financial records for the two companies for liability purposes, you can co-mingle their income and expenses on the single Q-Sub tax return.

Conclusion

For liability protection, it is wise to have the operations of ABC and XYZ be housed in their own separate LLCs. You can structure those separate LLCs to be owned by a single person, you. Or you can have the new company, XYZ, LLC be wholly-owned by the existing company, ABC, LLC.

Separate Companies, Same Owner may be an advantage while XYZ, LLC is operating at a loss, then that loss does not adversely affect the profitability and value of ABC, LLC. In addition, you may want to keep the companies separate because they address completely unrelated markets and you want to prepare each of them for separate sales to different buyers.

But once XYZ, LLC becomes profitable, the wholly-owned subsidiary relationship with a Q-Sub election may be the most financially advantageous structure when the two companies have overlapping markets and you want to sell them both to a single buyer of the combined operation.

But what is the best thing to do if you expect to bring on investors to one or the other company, not completely sell either of them? That is the subject of the next Part 3 in this series.

Entrepreneurs are going to save the world, and Argent Place Law wants to help. That’s why we are a team of entrepreneur-lawyers serving Entrepreneurs just like you. Think how great it will be to have a legal team with entrepreneurial experience on your speed dial so you can call us up and say, “We need to create a subsidiary company to buy the assets of a collapsing competitor, then file a Q-Sub election, how do we do that?” Set an appointment with Argent Place Law today; your first 30 minutes are free or call 703-539-2518.